Affordable Health Coverage

and a Supportive Community

Healthcare That Works for You

Individuals and businesses turn to us for affordable health coverage without compromise. Get comprehensive care, visit any doctor nationwide, and join a supportive community that shares medical costs.

What is Health Sharing?

Healthcare sharing is a creative method for managing healthcare expenses where members contribute monthly payments to cover each other’s eligible medical costs. In contrast to conventional health insurance, health sharing emphasizes community and mutual assistance.

The Benefits of Health Sharing

Members benefit from

Affordable health coverage.

Extensive services like preventive care, mental health support, and prescription discounts.

The liberty to consult any doctor in the United States.

This model enables individuals, families, and small businesses to save money while offering high-quality care. When members participate in health sharing, they collaborate to address medical expenses, offering a simple and direct alternative to traditional health insurance plans.

Who Can Benefit from Health Sharing?

Small Business Owners

Small business owners often struggle with expensive health insurance options that can be cost-prohibitive. We offer a cost-effective alternative for everyone—from sole-preneurs to small businesses with 49 or fewer employees. Membership benefits can also be extended to family members.

Individuals Without Insurance

For those without health insurance, healthcare sharing programs offer a practical alternative by providing access to medical care and addressing health needs at a more affordable cost. Members can visit any doctor across the country without the limitations of provider networks. This versatility, along with the possibility of reduced monthly expenses compared to insurance premiums, makes health sharing a desirable choice for those aiming to maintain good health without straining their finances.

Individuals with ITINs

Healthcare sharing programs can be particularly beneficial for individuals with Individual Taxpayer Identification Numbers (ITINs). These programs often have more inclusive eligibility requirements compared to traditional health insurance plans. This means that individuals who may not qualify for other types of coverage due to their immigration status can still access affordable healthcare through health sharing. Becoming part of a health sharing community offers peace of mind, with the reassurance that support is available for medical needs.

Maternity and Family Coverage

We understand the importance of comprehensive care for growing families. Our health sharing program offers robust maternity and family coverage to support you during life’s significant moments.

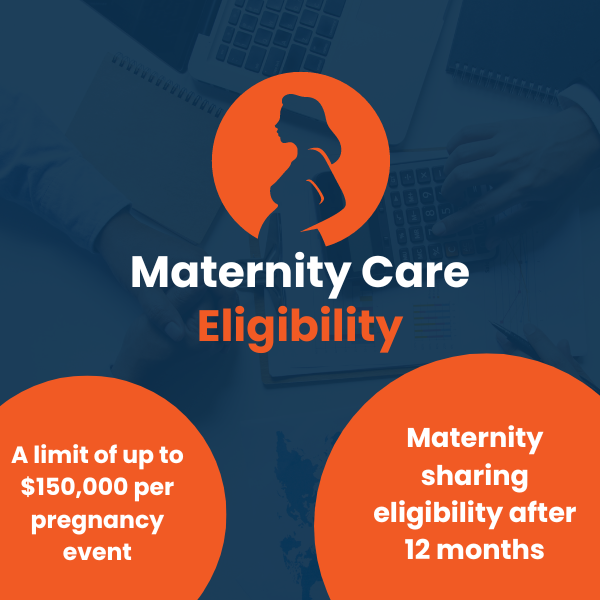

Maternity Care Eligibility

Maternity care is a key component of our program. Members who have been part of our community for at least 12 months are eligible for maternity sharing, with a limit of up to $150,000 per pregnancy event. Our coverage includes antepartum care, delivery, complications for both mother and child(ren), and postpartum care. By sharing these costs, we help alleviate the financial burden of maternity care, allowing you to focus on your family.

Family Coverage Options

Our plans work very well for the entire family. Share contributions begin at $378, providing an economical option compared to conventional health insurance. Family members have access to an extensive selection of medical services, such as preventative care, mental healthcare, 24/7 telemedicine, and prescription savings. And, because we don't have restrictive provider networks, you can select the most suitable provider for your family's health requirements.

Health Sharing for Seniors

We provide tailored health sharing solutions for seniors aged 65 and older, designed to enhance your healthcare experience. Key features of our program include:

01

Supplemental Coverage

Complements Medicare Parts A & B with additional assistance.

02

Primary Responsibility Amount (PRA)

Offers a $1,000 PRA option for added support.

03

No Provider Fees

Enjoy healthcare without any provider fees.

04

No Co-Share

Benefit from our program without any co-share requirements.

05

No Pre-existing Condition Limitations

Coverage is available regardless of pre-existing conditions.

06

Streamlined Healthcare

Simplifies the management of medical expenses and healthcare needs.

07

Community-based Sharing

Join a community that shares medical expenses, helping to reduce overall healthcare costs.

08

Affordable Coverage

Offers easy access to high-quality care at every stage of life.

Healthcare Sharing for Businesses

Health sharing is designed perfectly for small businesses and presents a distinctive, cost-efficient approach. Our model helps businesses manage healthcare costs while providing employees with high-quality care.

Tailored for groups of 49 or fewer members, this program harnesses community power to share medical costs, presenting an alternative to conventional health insurance. Employees appreciate both the benefits and the cost savings.

Tailored for groups of 49 or fewer members, this program harnesses community power to share medical costs, presenting an alternative to conventional health insurance. Employees appreciate both the benefits and the cost savings.

Affordable Options for Employees

Our health sharing plans are an ideal option for employees looking for affordable health plans. With plans starting at just $73 for individuals, employees can access comprehensive medical care without the financial strain typically linked to traditional health insurance plans. This includes preventative care, mental health services, prescription discounts, and 24/7 telemedicine so that employees and their families can stay healthy and address their medical needs promptly.

Group Coverage Details

Versatile health plans are available that let employees visit the doctor of their choice without adhering to a provider network. This adaptability makes sure that employees can obtain the medical care they require from their chosen providers. Our group billing solution makes administration easier for employers, offering a simplified monthly group bill and resources for efficiently managing the healthcare program. Family members of employees can also participate, making it an all-inclusive solution for everyone.

Employee Benefits

Employees benefit from a community-based approach where medical costs are shared among members, offering several advantages:

01

Reduced Financial Strain

Medical costs are shared, lessening the individual financial burden.

02

Primary Responsibility Amount (PRA)

After meeting an annual PRA ranging from $2,500 to $10,000, members only pay 10% of eligible medical bills.

03

Annual Household Limit

Members have an annual household limit of $5,000, providing additional financial protection.

04

Focus on Health

This model enables workers to prioritize their health without the stress of high medical costs.

05

Coverage for Pre-existing Conditions

Pre-existing conditions are covered after 36 months of membership.

Sign up for affordable health coverage today, and offer your team a low-cost, all-inclusive healthcare option that prioritizes both their health and financial well-being.

Common Shared Medical Expenses

A wide range of medical expenses can be shared among members, offering a reliable alternative to traditional health insurance plans. Members receive support for various health needs, effectively managing healthcare costs.

Doctor Visits

Regular doctor visits are crucial for maintaining good health. With our share plan, members can see any doctor nationwide without network restrictions. This flexibility offers high-quality care customized to individual health needs, keeping members healthy and receiving necessary treatments.

Hospital Stays

Hospital stays can be a significant financial burden. Our healthcare-sharing model allows members to share the costs of hospital stays, including surgeries and other inpatient services, alleviating financial stress from medical emergencies and inpatient treatment.

Prescription Drugs

Prescription drugs are a significant aspect of healthcare, often playing a crucial role in managing chronic conditions, treating acute illnesses, and maintaining overall health. This is where our plan steps in, offering a solution that can help members manage these expenses more effectively.

Why Choose Health Sharing for Family and Business?

Cost-Effective Solutions

Health sharing offers a budget-friendly alternative to traditional health insurance. With lower monthly contributions and minimal administrative costs, members can save significantly on healthcare expenses. This approach allows individuals and families to access affordable health coverage without compromising quality care.

Community-Driven Support

Health sharing fosters a sense of community among members with similar values and health goals. By pooling resources, participants support each other's medical needs, creating a collaborative approach to healthcare. This model motivates members to be proactive about their health and wellness. They also benefit from the strength of being part of a group.

Transparent and Simple Process

Health sharing plans offer a simpler and more transparent alternative to complex insurance policies, with several important benefits:

Straightforward Guidelines: Easy-to-understand guidelines and processes make health sharing plans accessible.

Transparency: Members have clear visibility into how their contributions are used and what medical expenses are eligible for sharing.

Reduced Stress: The simplicity and transparency help reduce the stress associated with navigating traditional health insurance claims.

Creative Coverage Solution: Health sharing provides an innovative option for affordable health coverage without the limitations of conventional insurance plans.

Cost Reduction: Members can potentially lower their healthcare costs while still accessing high-quality care.

Community Connection: Staying connected to a caring community is a central aspect of health sharing plans.

Get Your Quote Today

Find out how to access high-quality care at an affordable price. Through health sharing, you can reduce expenses for your medical needs while experiencing adaptable health plans customized to your way of life.

Join our community and start sharing medical costs with other members who value affordable health coverage.

Get started by obtaining your personalized quote and seeing how much you can save on your healthcare expenses.

Get your quote now and be on your way to more affordable healthcare.

Health Sharing FAQs

Health sharing involves community members making monthly payments to cover each other’s medical costs. It’s a legitimate alternative to traditional health insurance, offering potential cost reductions and aligning with many members’ values and financial goals.

Health sharing plans are legitimate alternatives to traditional health insurance, recognized by many states and the federal government. These plans operate on a voluntary basis, with members agreeing to share medical costs according to established guidelines. While not insurance, they provide a framework for managing healthcare expenses. It’s important to thoroughly research and understand the terms of any health sharing plan before joining.

Health sharing plans offer affordable healthcare with lower monthly expenses and more flexibility than traditional insurance. The worth of these plans depends on individual health needs, healthcare budget, and comfort with the sharing model. Many members appreciate the community-focused approach and potential cost savings.

Health insurance offers coverage for a set premium, with legal contracts and regulations. Health sharing is a cooperative approach where members contribute to a pool for eligible medical expenses. It can offer flexibility and potentially lower costs, but it lacks the legal protections of insurance. The choice between the two depends on personal preferences, health status, and financial considerations.

An example of a shared cost might be when members collectively contribute to cover the medical expenses of another member. For instance, if a member incurs a $300 medical bill, the cost may be shared among the community members who contribute a portion of their monthly share to help cover the expense, according to the program’s guidelines, the level of participation, and whether the member’s primary responsibility amount has been met.

Health sharing payments are generally not tax deductible, unlike traditional health insurance premiums, which may be deductible if you itemize deductions and meet certain requirements. However, many individuals find it challenging to benefit from insurance tax deductions due to the stringent requirements and the need to exceed a certain percentage of their adjusted gross income.

Lowering healthcare costs involves preventive care, regular check-ups, and using telemedicine services for non-emergency consultations. Savings can be made by comparing prices for medications and medical services and opting for generic drugs. Health sharing programs also offer a way to reduce costs through community-based expense sharing.